Do rich people pay their fair share of taxes?

There’s a trope that Democrats want high taxes and Republicans want low taxes. The actual difference between the parties is that Democrats want progressive taxes and Republicans want regressive taxes.

Progressive taxation means that richer people pay a higher proportion of their income in taxes than poorer people.

Regressive taxation means that poorer people pay a higher proportion of their income in taxes than richer people.

The status quo

Right now, income taxes are progressive (in large part), and every other tax is regressive. Individual income taxes represent about 51% of federal government revenue. Corporate income tax represents around 10%, payroll taxes represent about 35%, and excise taxes represent about 2.5%.

Regressive taxes

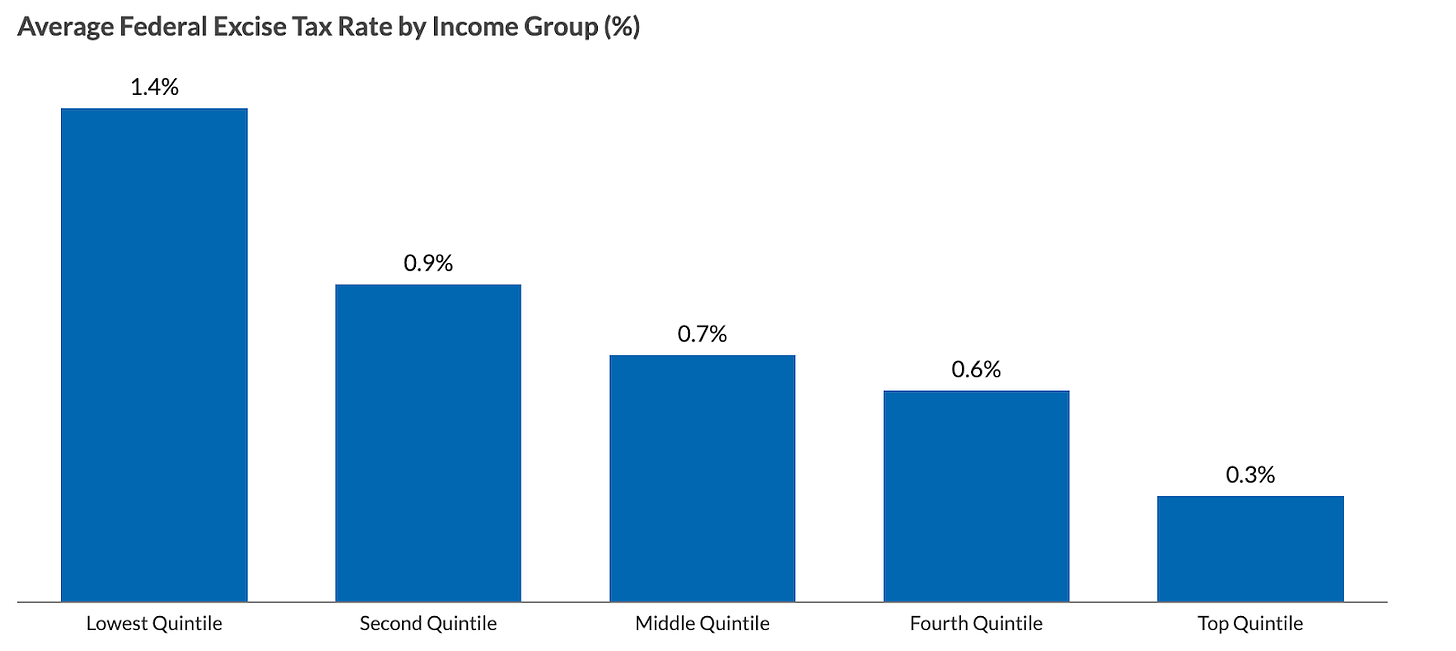

Excise taxes are taxes on the consumption of goods and services. This category includes all sale taxes and additional taxes on certain goods, including gasoline, tires, alcohol, and cigarettes.

Individuals all pay the same percentage tax on their purchases regardless of income, but the aggregate effect of these taxes is regressive because poorer people spend a much larger proportion of their income on taxable goods.

Mostly that’s because rich people have enough money that they can spend a lot of it to buy investment assets, which are not taxed at purchase. Poorer people spend a much higher portion of their money on food, clothes, and gas, so they wind up paying a much higher portion of their income on excise taxes.

This is how a flat tax rate actually has the regressive effect of costing poorer people relatively more of their income than it costs richer people.

Payroll taxes are even more regressive. Everyone who gets a paycheck for their work in America (including non-citizens) pays payroll taxes. About 73% of payroll taxes go toward funding Social Security. The Social Security portion is paid at 6.2% of employees’ salary until the employee earns over $176,100, at which point they have hit their Social Security cap and they stop paying Social Security tax. Social Security tax is an extreme kind of regressive tax where the richer you are, the lower the effective tax rate you pay.

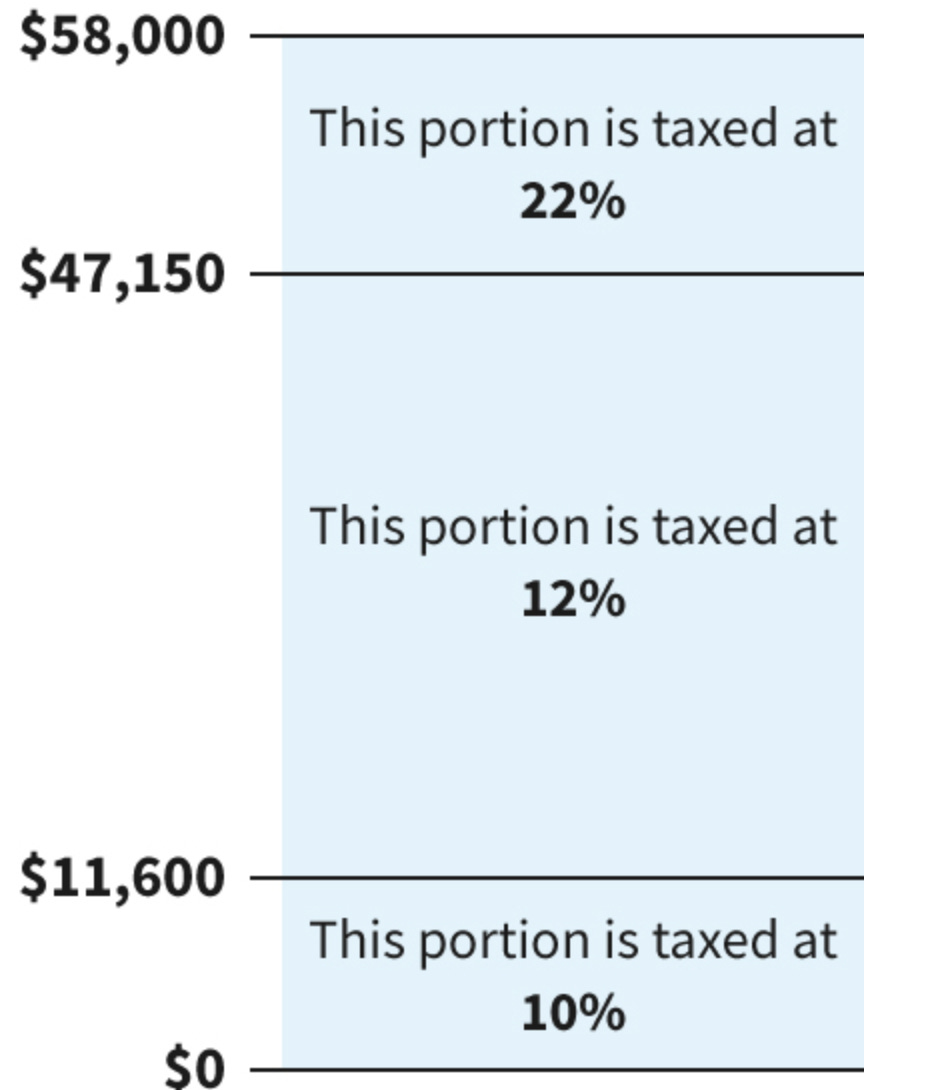

Individual income tax is the only part of the tax code that has even a nod toward progressive taxation. The way it works is that there are a few different tax brackets. When someone makes enough money to move into a higher bracket, then every marginal dollar they make beyond the threshold of that bracket gets charged at the new rate, while all their previous income gets charged at the rates of lower brackets.

Notice that the current tax rates stop increasing after $609,351. These tax brackets are progressive. They increase as the taxpayer’s income increases. Democrats would like them to continue to progress. They argue that there should also be higher tax rates for incomes that go over $1M, $2M, $5M, etc.

The current tax brackets are the result of decades of political fighting in which Democrats argue for more progressive taxation that scales into the incomes of the super wealthy, while Republicans want less progressive taxation that stops progressing at a lower income level. Actually, many Republicans - including Trump over the last several months - would prefer that income tax be completely flat (which would have a regressive effect) or that it be removed altogether and replaced with excise taxes (which would be extremely regressive).

Loopholes in the individual income tax

The individual income tax rates look like they are progressive, even if they’re not as progressive as Democrats would like them to be. But these brackets are misleading. There are two big loopholes that wealthy people use that undercut the tax progression.

The first is capital gains tax. Taxes paid on capital gains - which are increases in the value of investment assets - are charged at a lower rate than regular income. If you hold an investment for more than a year, you’re charged a 15% tax on capital gains between $48,351 and $533,400, and 20% on capital gains over about $533,400. Poorer people don’t make much money from capital gains, but that’s how the wealthy make the vast majority of their money. A person who makes $10M in a year from their investments will pay a lower tax rate on that income than the marginal rate for a salaried worker making $48,000 a year.

The second is a more complicated one, summed up by the phrase “Buy, Borrow, Die”, and it’s the strategy used by mega-billionaires to pay almost nothing in taxes. Here’s how it works.

Let’s say you’re Mark Zuckerberg. You have about $180B in Meta stock. If you sold your stock, you’d have to pay a capital gains tax of about 20% on your profits. What Zuckerberg and other billionaires do instead is they take out loans against their equity stakes in these companies. Zuckerberg goes to a bank and says he wants to open a line of credit for a personal loan using his Meta stock as collateral. The bank is more than happy to do it; the collateral is enormous and reliable, and they want to have a good relationship with Zuckerberg because they want his company to use their bank for its banking needs.

The bank gives Zuckerberg a permanent line of credit at extremely favorable terms. He gets a lower personal loan rate than anyone else can get - lower than inflation.

Zuckerberg can take out billions of dollars from the bank anytime he wants, and use it to buy islands and mansions, send his kids to private school, hire an army of workers to manage his household, and so on. He’s living off of the billions of dollars he’s borrowing from the bank and he never has to pay taxes on it because it’s not income.

Zuckerberg will do this for the rest of his life. Then when he dies, his heirs will inherit his (trillion-dollar?) equity stake. They can choose to borrow against it for their whole lives and never pay taxes on it, the way their father did. Or they can sell it immediately and not have to pay taxes on it, thanks to something called stepped-up basis. What this means is that all previous capital gains accrued by the owner of the asset are wiped away upon inheritance, so the heir can sell the asset at its current value without having to pay a cent in taxes.

This whole process allows America’s wealthiest people to claim that they have low incomes even while they’re increasing their net worth by billions of dollars a year and spending hundreds of millions a year on lavish lifestyles. In 2011, Jeff Bezos was worth $18B, but reported so little income to the IRS that he was able to claim the Child Tax Credit reserved for couples making under $130,000.

When you look at a chart that shows how progressive our country’s individual income tax system is, remember that the ultra-wealthy live outside of that system and live off of tax-free loans while claiming to have paltry incomes.